By Stephanie Clue [1]

BELLEVILLE – Many students struggle with finances and personal debt, but there are ways to make the problem less stressful.

Matthew Chamilliard is a second-year student in the Motive Power Technician [2] program at Loyalist College and he says saving money is a must for him.

“I pay tuition out of pocket, so I need to save my money in order to go to school here,” he said.

Being a student, Chamilliard says, is expensive, having to pay for textbooks and other things for school, “It becomes difficult to save money when you have to keep dolling it out for school.”

Chamilliard has a car and says owning one makes it even harder to save money.

“You have to pay for gas all the time and insurance and you have to pay for maintenance. But I think having a car is worth it because you’re able to get to school and work and you don’t need to rely on public transportation,” he said.

Unlike many students, Chamilliard budgets his money. He says his pay checque gets divided into four different savings accounts.

“Some of the money goes into an account for my phone bill, some to pay for gas and I have another one that takes $50 out automatically every time I get paid, so that adds up pretty fast,” Chamilliard said.

Kelsey Irwin is a student in the Pre-Health Science [3] program at the college and says she has trouble saving money.

“I like to spend money on things for myself like clothes and I also spend a lot of money on makeup,” Irwin said.

Irwin says she struggles to prioritize about what to spend her money on.

“I’ll see something I like and I buy it, even though I know I shouldn’t. As I walk out of the store I think ‘probably shouldn’t have bought that’ but I did anyways.” She says to start saving money she needs to convince herself not to buy things she doesn’t need and focus on things like textbooks and gas for her car.

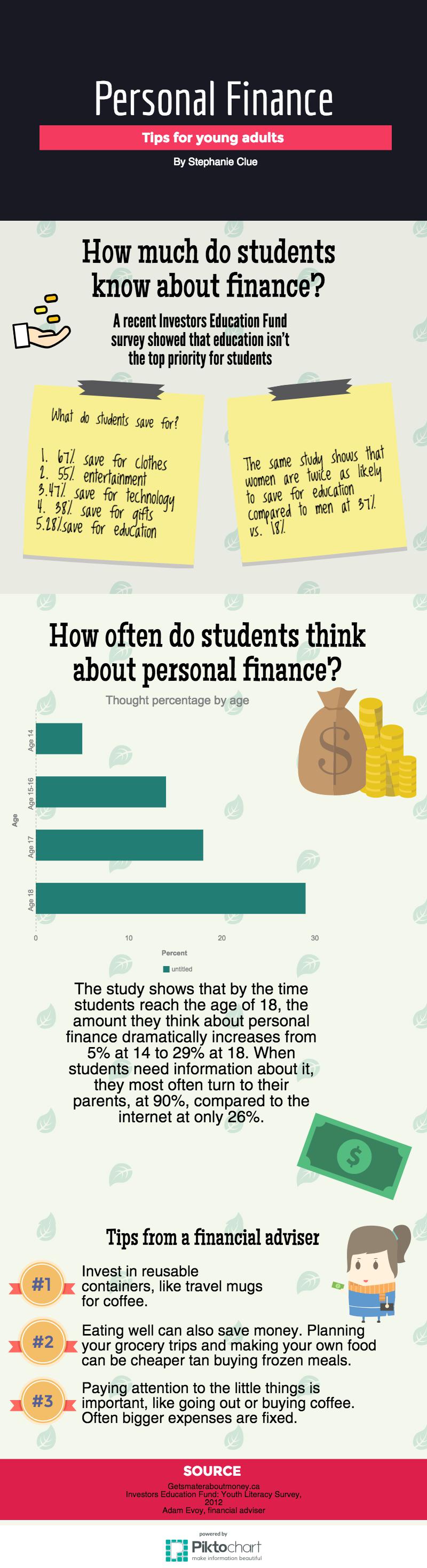

Adam Evoy is a financial adviser with Freedom 55 [4] in Belleville. He says budgeting is one of the most important things students and young adults can learn.

“I can’t stress enough the importance of where your money is going. I hear it from clients on a regular basis that don’t have a handle on the activity in their accounts,” he said.

Evoy says to start making a budget, you need to make a list of your expenses and any income you are expecting. Once you figure out how much you want to spend, you can then set a goal. Budgeting can lead to paying off student loans.

“The great thing about the Ontario Student Assistance Program [5] is that the interest you pay on it every year is tax deductible. They’re very good at staying in touch with you and making sure the payments are made,” Evoy said.

Most of Evoy’s clients are under thirty and he says many of them want to know what they should be doing with their savings.

“A lot of them ask ‘how come I’m paying this much, but there isn’t any money?’ and they want to know how to save for retirement,” said Evoy.

To make saving money easier, Evoy suggests getting a tax free savings account [6], which is money that the government can’t tax. He also encourages people to have an emergency fund, which is money that can be accessed very quickly.

As for OSAP, Evoy says students graduating school should be aware of the expenses.

“‘Just because the payments don’t kick in for six months, doesn’t mean you shouldn’t be thinking about it,” he said.