By Jessica Clement [1]

BELLEVILLE – The winter semester is in full swing for students across Ontario, and many say their minds are on money rather than classes.

OSAP provides 60 per cent of the allotted money in first semester and 40 per cent in second semester. Student loans are running dry according to some at Loyalist College.

“Right now I’m surviving off my father’s death benefit and a credit line. In the future I will have to pay it back. I am also a returning alumni so I’m also paying back OSAP. My credit line is paying for that right now,” said fitness student Mathieu Leduc.

A study [6] done by the Canadian Centre of Policy Alternatives [7] says that not only has the average tuition and compulsory fees in Canada tripled since 1990, but Ontario students pay the highest fees of all other provinces.

“The struggle of a college student is a real thing and I do believe things are way too expensive considering the fact that our parents were able to afford a full year working a summer job, now we barely skim by,” said Leduc. He is trying to jump-start his career in order to pay back student loans and OSAP.

Tim Devries says it’s not easy, “I find people rarely get into their profession right away regardless of whether or not they finish their program. We all end up working minimum wage fast-food or retail (jobs) for a while and that’s what I’ve been doing.”

Devries was an animation student at Loyalist who commuted to Belleville from a rural town every day. Without a vehicle, he said he was forced to pay for a $14 bus each way every day to attend classes. He says that coming from a low-income family, this made money tight. Devries said he thought he had found a solution by moving into the city of Belleville. But that didn’t work either.

“Transit costs made it seem like moving into Belleville would’ve been so much easier. However, I didn’t have the financial stability to live in town due to unemployment.” He eventually dropped out due to the stress and said he is doing factory work until he can find a more suitable job.

This graph shows the average OSAP debt for three levels of study between 2003 and 2013. Hover your cursor over a year to see the average OSAP debt for that time frame.

“I think it will be okay,” Leduc said, “It is all about stress-management. I am a third-year student so by now I think I am able to see things coming and know how to deal with them.”

Students are expected to budget well and contribute towards the cost of tuition and living expenses according to Dawn Price from Loyalist’s Financial Aid office. “We’ve gone to OSAP about changing the system from 60/40 to 50/50, but they can’t.” When asked why OSAP distributes money this way she said, “they’ve just always done it this way.” Price said she believes it has to do with covering the cost of books and rent at the beginning of the school year.

“We know it’s an issue for students, so we have a financial need bursary that’s only available in January,” Price said, which she says can total as much as a few hundred dollars to a thousand depending on the amount of applicants.

However, finance troubles carry on after graduation, said Amanda Boyle, “I’m working my ass off at my low-paying job in my field , and I basically have no money to live on after paying my OSAP and line of credit bills.” We asked her for her opinion on costs that come with attending post-secondary, “(They) are outrageous and unnecessary. There are countries that offer free post secondary, so why can’t we? It’s almost impossible to make a decent wage or salary in today’s world without going to post secondary, but after all the costs and bills from school you’re right back to where you started.”

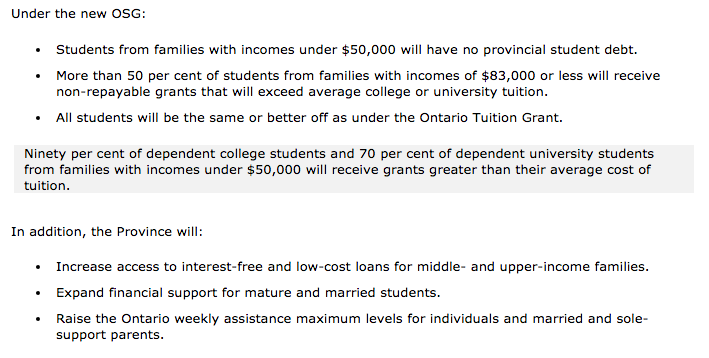

Next year Ontario students will have access to “more affordable” tuition [8], according to the Ontario Ministry of Finance. The OSG has said they will make the average college and university tuition free for students from low-income families, and offer more affordable tuition for those from middle-class families. Price said that it isn’t technically free though. Instead, students will still be charged for tuition but will also receive a non-repayable grant that matches or exceeds the cost.

Screenshot from the Ontario Ministry of Finance page affordable tuition page.